Blockchain Privacy: Why Transaction Mixing Matters

Explore the critical importance of blockchain privacy, the risks of transaction traceability, and how mixing services protect user anonymity in the transparent world of cryptocurrency.

The Transparency Problem in Blockchain

Blockchain technology, while revolutionary in its approach to decentralized systems, presents a fundamental privacy challenge: complete transparency. Every transaction is recorded on a public ledger, visible to anyone with internet access. This transparency, while beneficial for verification and trust, creates significant privacy risks for users.

The public nature of blockchain transactions means that sophisticated analysis tools can trace the flow of funds, identify spending patterns, and potentially link transactions to real-world identities. This level of traceability poses serious concerns for personal privacy, business confidentiality, and financial security.

The Reality of Blockchain Analysis

Modern blockchain analysis has become incredibly sophisticated. Companies like Chainalysis, Elliptic, and others have developed powerful tools that can:

- Track transaction flows across multiple addresses

- Identify spending patterns and behavioral analysis

- Link addresses to real-world identities

- Monitor compliance with regulatory requirements

"Privacy is not about hiding illegal activities; it's about protecting legitimate financial privacy and personal autonomy."

Why Privacy Matters in Cryptocurrency

Financial privacy is a fundamental human right that has been eroded in the digital age. Traditional banking systems, while not perfect, provide some level of privacy through account-based systems and regulatory protections. Cryptocurrency, with its transparent blockchain, initially lacked these privacy protections.

Personal Privacy Protection

Individuals have legitimate reasons to protect their financial privacy:

- Personal Security: Preventing targeted attacks based on wealth visibility

- Business Confidentiality: Protecting sensitive business transactions

- Family Safety: Shielding family members from financial exposure

- Political Freedom: Avoiding persecution in authoritarian regimes

Economic Benefits of Privacy

Privacy in financial transactions provides several economic benefits:

First, it prevents front-running and market manipulation by hiding large transactions until they're executed. Second, it protects commercial strategies and business relationships from competitors. Third, it enables more efficient markets by reducing information asymmetry.

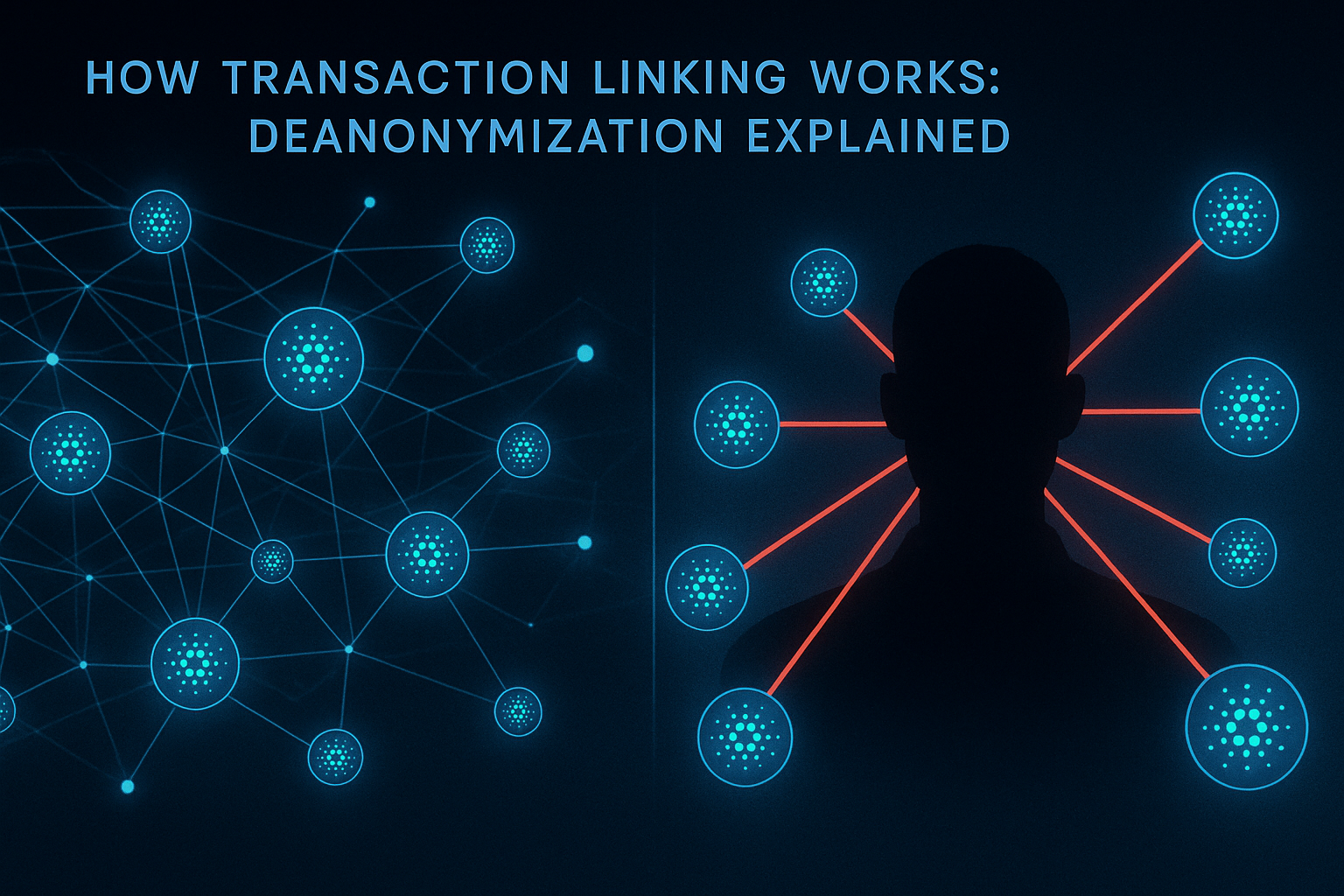

The De-anonymization Risk

Without proper privacy measures, blockchain transactions can be de-anonymized through various techniques:

Address Clustering

Analysts can group addresses that are likely controlled by the same entity based on transaction patterns, timing, and other heuristics. This clustering can reveal the full scope of an individual's or organization's cryptocurrency holdings.

Timing Analysis

Transaction timing can reveal relationships between addresses. For example, if two addresses consistently transact at the same time, they may be controlled by the same entity or have a business relationship.

Amount Correlation

Unique transaction amounts can be used to link transactions across different addresses. If someone sends exactly 1.23456789 BTC to an exchange, and later withdraws the same amount, the connection becomes obvious.

How Transaction Mixing Protects Privacy

Transaction mixing, also known as coin mixing or tumbling, is a privacy technique that breaks the direct link between input and output addresses. Here's how it works:

The Mixing Process

When users want to mix their coins, they send their cryptocurrency to a mixing service. The service pools these funds with other users' funds and then sends clean coins back to the users' specified addresses. This process breaks the direct transaction link.

Anonymity Sets

The effectiveness of mixing depends on the size of the anonymity set – the number of users participating in the mixing process. Larger anonymity sets provide better privacy protection because it becomes more difficult to identify individual transactions.

Time Delays and Amount Mixing

Advanced mixing services implement time delays and amount mixing to further obfuscate transaction patterns. This makes it extremely difficult for analysts to trace the flow of funds.

Types of Mixing Services

There are several types of mixing services, each with different privacy and security characteristics:

Centralized Mixers

Centralized mixers are operated by a single entity that controls the mixing process. While they can provide good privacy, they require trust in the operator and may be vulnerable to regulatory pressure or technical attacks.

Decentralized Mixers

Decentralized mixers use smart contracts and cryptographic protocols to enable mixing without requiring trust in a central operator. These systems are more resistant to regulatory pressure but may be more complex to use.

Peer-to-Peer Mixing

P2P mixing protocols allow users to mix coins directly with each other without involving a third-party service. This approach maximizes privacy but requires more coordination between participants.

Privacy Coins vs. Mixing

While privacy-focused cryptocurrencies like Monero and Zcash provide built-in privacy features, mixing services offer privacy for popular cryptocurrencies like Bitcoin and Ethereum. This is important because:

Liquidity and Adoption

Bitcoin and Ethereum have the highest liquidity and adoption rates. Users who want privacy but need to use these popular cryptocurrencies can benefit from mixing services.

Regulatory Compliance

Some jurisdictions have restrictions on privacy coins but allow the use of mixing services for legitimate privacy purposes. This provides users with privacy options while maintaining regulatory compliance.

The Future of Blockchain Privacy

As blockchain technology continues to evolve, privacy solutions are becoming more sophisticated:

Zero-Knowledge Proofs

Zero-knowledge proof systems like zk-SNARKs and zk-STARKs are being integrated into blockchain protocols to provide privacy while maintaining verifiability.

Confidential Transactions

Confidential transaction schemes hide transaction amounts while still allowing verification of the transaction's validity. This provides privacy for transaction amounts while maintaining transparency for other aspects.

Cross-Chain Privacy

Future developments may enable privacy-preserving transactions across different blockchain networks, providing even greater flexibility and privacy options for users.

Regulatory Considerations

The regulatory landscape for privacy-enhancing technologies is complex and evolving:

Legitimate Use Cases

Privacy in financial transactions serves many legitimate purposes, including personal security, business confidentiality, and protection from discrimination. These use cases should be protected while preventing misuse.

Compliance Challenges

Balancing privacy with regulatory compliance is a complex challenge. The best solutions provide privacy while maintaining the ability to comply with legitimate law enforcement requests when necessary.

Best Practices for Privacy

Users who want to protect their privacy should follow these best practices:

Use Multiple Addresses

Never reuse addresses for multiple transactions. Generate a new address for each transaction to prevent address clustering.

Implement Time Delays

Vary the timing of transactions to prevent timing analysis. Don't make transactions at predictable intervals.

Use Mixing Services

Regularly use mixing services to break transaction links and maintain privacy. Choose services with strong privacy guarantees and security practices.

Be Aware of Metadata

Remember that blockchain transactions are just one part of the privacy equation. Be aware of other metadata that could be used to identify you, such as IP addresses, transaction patterns, and behavioral analysis.

Blockchain privacy is not just a technical challenge – it's a fundamental requirement for the widespread adoption of cryptocurrency. As the technology matures, we can expect to see more sophisticated privacy solutions that protect user anonymity while maintaining the transparency and verifiability that make blockchain technology valuable.